Dual-aspect living room with private balcony and good natural light.

Allocated underground parking space included.

Currently tenanted until 10 September 2025 (rental income £1,250 pcm).

Reported 9.4% gross yield (£15,000 pa) before charges.

Leasehold with 103 years remaining.

Service charge c. £3,051.04 pa; ground rent £250 pa.

Double glazing and modern kitchen — low immediate refurbishment need.

Local area recorded as very high crime — affects insurance and management.

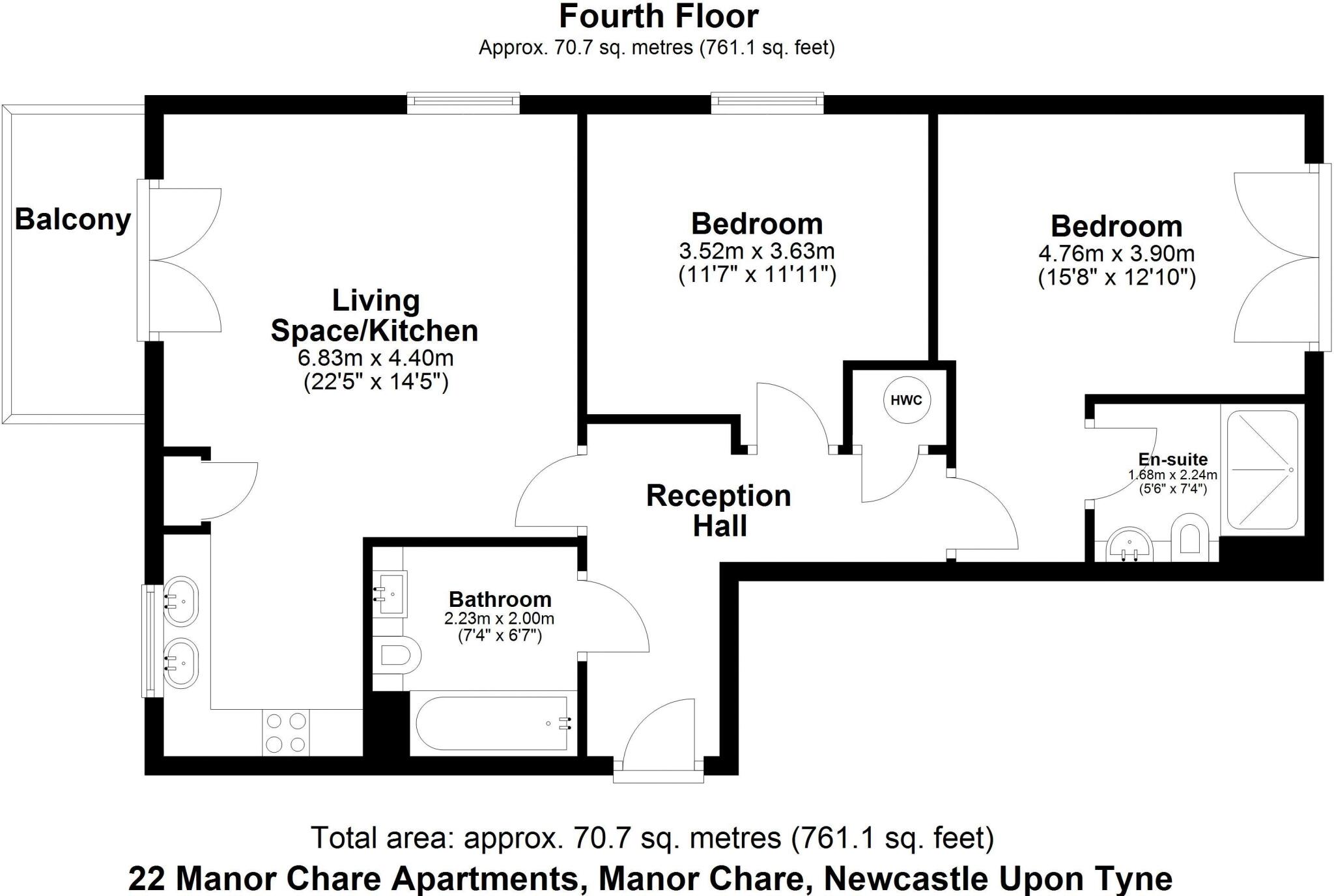

Set on the fourth floor of a popular Quayside block, this two-bedroom apartment offers dual-aspect living, a private balcony and an allocated underground parking space. The open-plan kitchen/living area floods with natural light and the principal bedroom benefits from an en-suite and Juliet balcony — practical features for both renters and owner-occupiers.

The property is currently let at £1,250 pcm (£15,000 pa), giving a reported 9.4% gross yield before service charge and ground rent. It comes chain free but remains tenanted until 10 September 2025, making it an immediate income purchase for investors or a straightforward buy-to-let acquisition.

Costs and tenure are straightforward: leasehold with 103 years remaining, service charge around £3,051.04 pa and ground rent £250 pa. Double glazing and modern fittings minimise immediate maintenance, but the service charge is a material ongoing cost that affects net returns.

Location is a defining strength — immediate access to Newcastle Quayside’s bars, restaurants and transport links encourages strong rental demand, particularly from students and young professionals. Buyers should note local crime levels are recorded as very high; factor this into management, insurance and tenant decisions.