Summary - Brabloch Park, Paisley, PA3 PA3 4QD

2 bed 2 bath Flat

Compact, income-producing flat with long-term tenant and clear rent-up potential for investors.

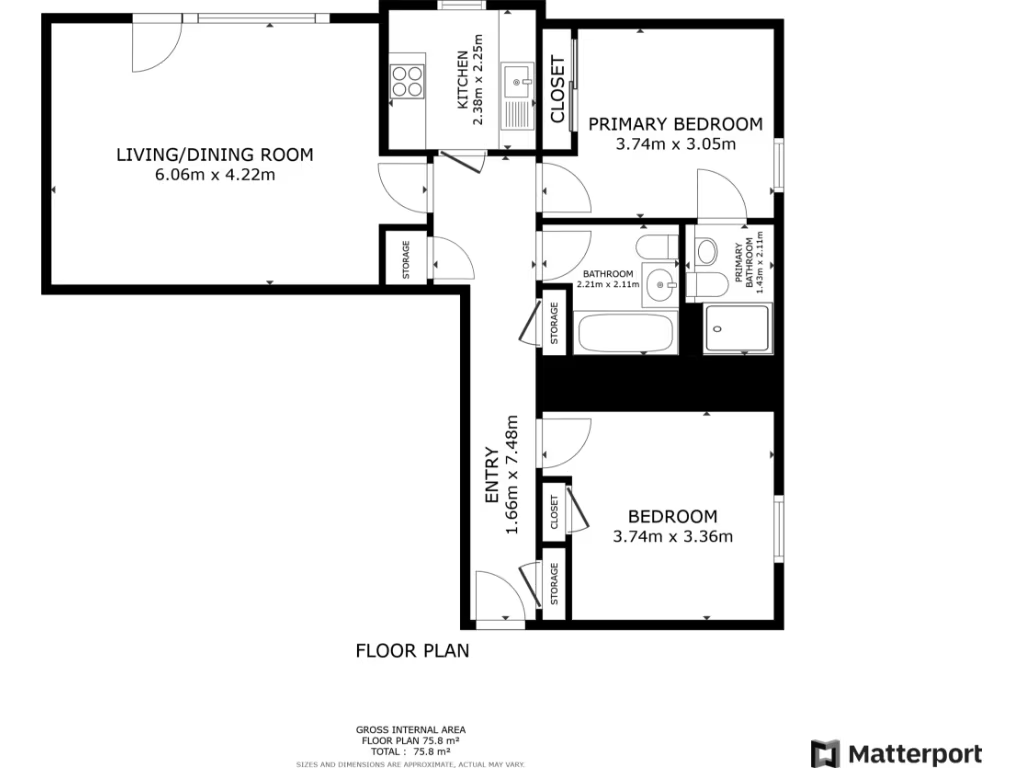

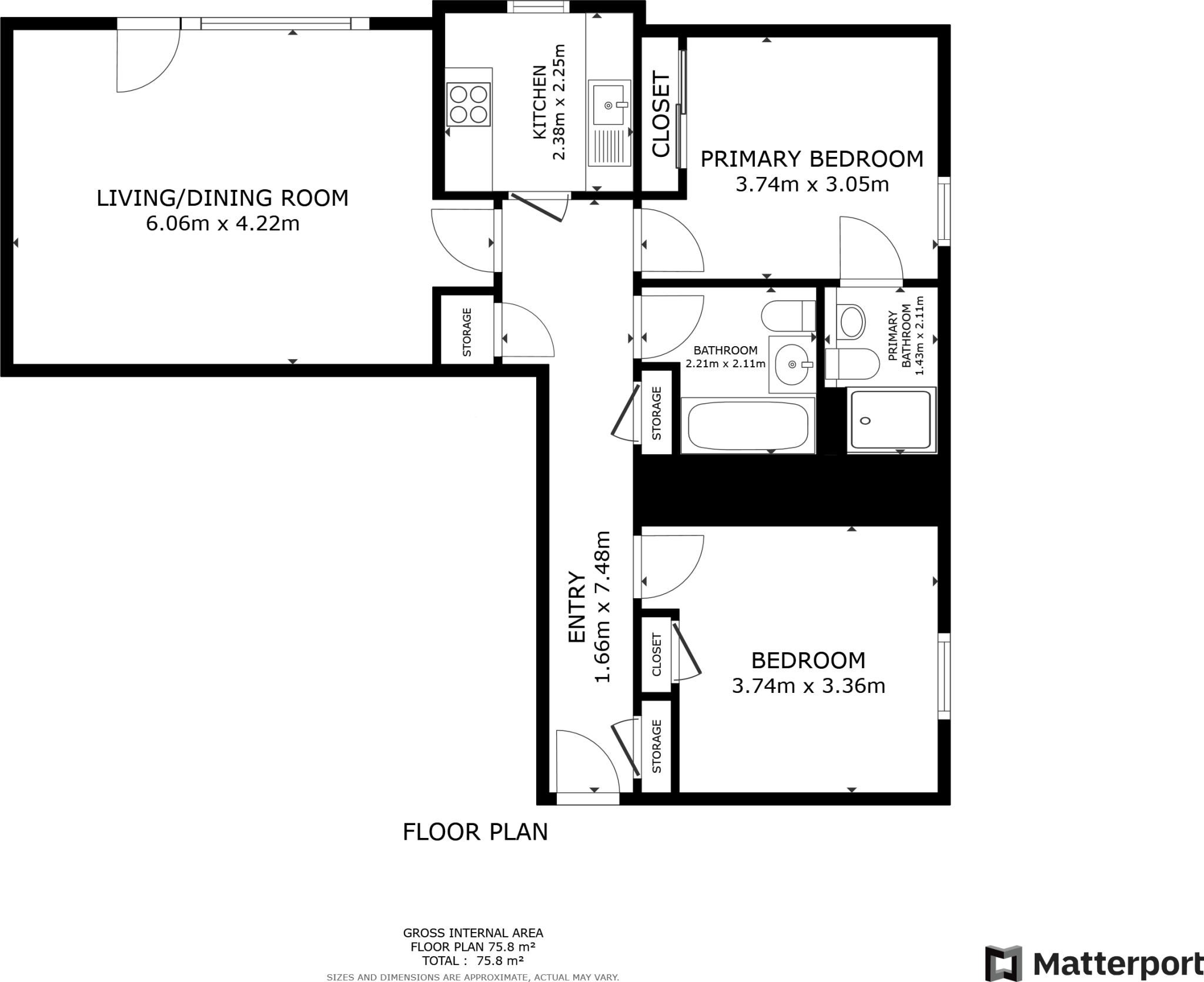

- Freehold two-bedroom flat, roughly 466 sq ft

- Currently let with long-term tenants in situ

- Current gross income £7,200; potential market rent ~£10,200

- Good condition internally; includes ensuite and three-piece bathroom

- Fast broadband and excellent mobile signal

- Area classed as very deprived; local demand from commuter migrants

- Small overall size may limit owner-occupation appeal

- Buyers’ premium applies; check Let Property Pack and tenancy terms

A compact two-bedroom freehold flat in Brabloch Park, Paisley, presented as a straightforward buy-to-let for serious investors. The property is in good condition with a lounge, kitchen, ensuite and a three-piece bathroom, and benefits from fast broadband and excellent mobile signal — useful for long-term tenants.

The flat is currently let and produces a reported gross income of £7,200 per year; assessment suggests a potential market rent of about £10,200 annually, increasing yield for a new owner. Long-term tenants are in situ and wish to remain, so this is best suited to investors seeking immediate, low-management rental income rather than vacant possession.

Important considerations: the overall floor area is small (approximately 466 sq ft) and the building sits in an area classified as very deprived with a local profile of hard-pressed flat dwellers. A buyers’ premium will apply on sale; purchasers should review the Let Property Pack and tenancy details before bidding. No flood risk is reported, and parking and communal access are indicated but may be limited.

For an investor prioritising immediate rental returns and minimal void risk, this compact Paisley flat is a pragmatic, income-producing addition. Those looking for capital-growth renovation projects or owner-occupation should weigh the small size and local area factors carefully.

2 bedroom flat for sale in Rowan Wynd, Paisley, Renfrewshire, PA2 — £100,000 • 2 bed • 2 bath • 786 ft²

2 bedroom flat for sale in Rowan Wynd, Paisley, Renfrewshire, PA2 — £100,000 • 2 bed • 2 bath • 786 ft² 2 bedroom flat for sale in Rowan Wynd, Paisley, Renfrewshire, PA2 — £100,000 • 2 bed • 2 bath • 786 ft²

2 bedroom flat for sale in Rowan Wynd, Paisley, Renfrewshire, PA2 — £100,000 • 2 bed • 2 bath • 786 ft² 1 bedroom flat for sale in West Street, Paisley, Renfrewshire, PA1 — £45,000 • 1 bed • 1 bath • 420 ft²

1 bedroom flat for sale in West Street, Paisley, Renfrewshire, PA1 — £45,000 • 1 bed • 1 bath • 420 ft² 2 bedroom flat for sale in Netherhill Road, Paisley, PA3 — £65,000 • 2 bed • 1 bath • 689 ft²

2 bedroom flat for sale in Netherhill Road, Paisley, PA3 — £65,000 • 2 bed • 1 bath • 689 ft² 2 bedroom flat for sale in Seedhill Road, Paisley, PA1 — £64,000 • 2 bed • 1 bath

2 bedroom flat for sale in Seedhill Road, Paisley, PA1 — £64,000 • 2 bed • 1 bath 1 bedroom flat for sale in Broomlands Street, Paisley, PA1 — £32,000 • 1 bed • 1 bath • 452 ft²

1 bedroom flat for sale in Broomlands Street, Paisley, PA1 — £32,000 • 1 bed • 1 bath • 452 ft²