Tenant in situ at £650 pcm — immediate income and 9.75% gross yield

Newly modernised open-plan living room and kitchen throughout

Allocated off-street parking space and communal gardens

EPC rating C; council tax Band A — relatively low running costs

Leasehold tenure and property to be sold at auction — check legal pack

Main heating via electric room heaters (no central heating)

High local flooding risk — affects insurance and mortgage options

Located in a very deprived area — consider long-term capital growth

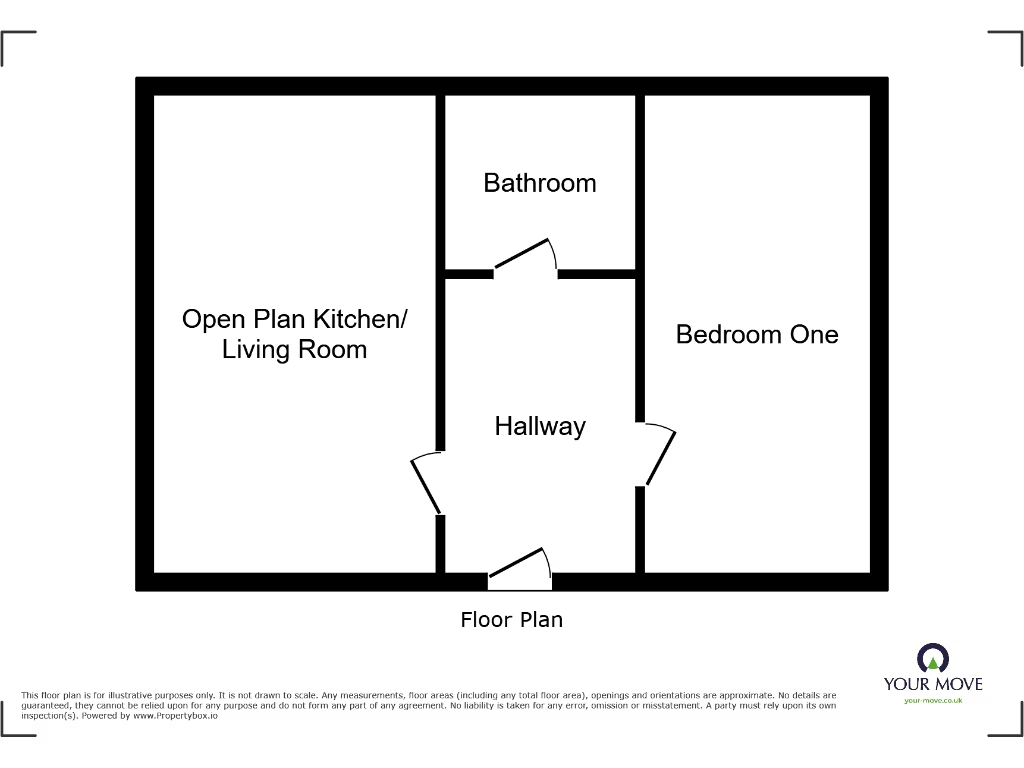

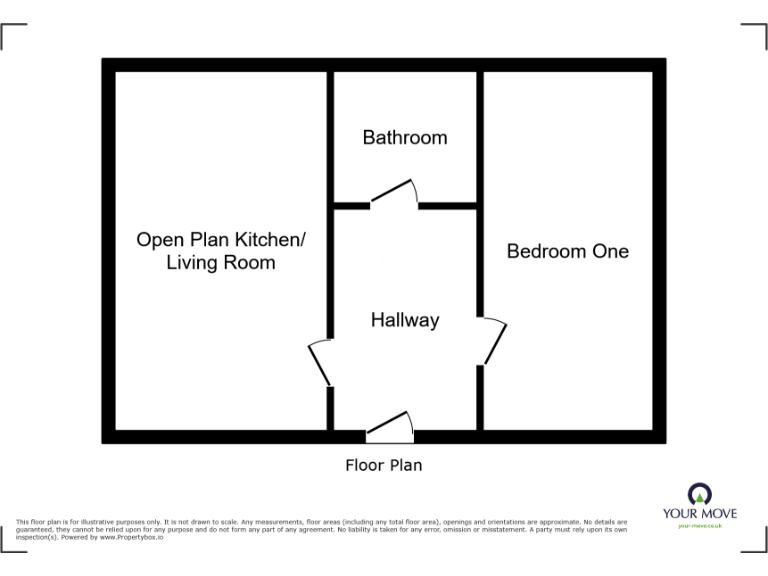

A one-bedroom penthouse apartment in Waterside Gardens offered with a tenant in situ at £650 pcm, presenting an immediate income stream and a gross yield of 9.75% at the guide price. The flat is newly modernised throughout with an open-plan living room and kitchen, a contemporary three-piece bathroom, double bedroom and an allocated off-street parking space. Communal gardens and modern double glazing (post-2002) add to the practical appeal.

This is a leasehold property being sold at auction, so purchasers should allow time for legal pack review and settlement procedures. Energy performance is rated C and council tax band A keeps running costs relatively low; however, heating is by electric room heaters which may affect longer-term energy costs and tenant affordability compared with central heating.

Important risk factors: the location has a high flooding risk and the area is described as very deprived; both should be considered for insurance, mortgage terms and long-term capital growth. The property will be sold with the existing tenant in place, so any purchaser must take the tenancy and existing rent stream as-is.

Overall this flat suits an investor seeking a turn-key, low-management unit with immediate rental income and a strong headline yield. Allow for the auction process, leasehold considerations and local area factors (flooding risk, deprivation) when assessing holding period and exit strategy.