Freehold three-bedroom mid-terrace, newly renovated

Tenant in situ — producing £475 PCM (£5,700 pa)

Gross yield approx. 8.1% at asking price

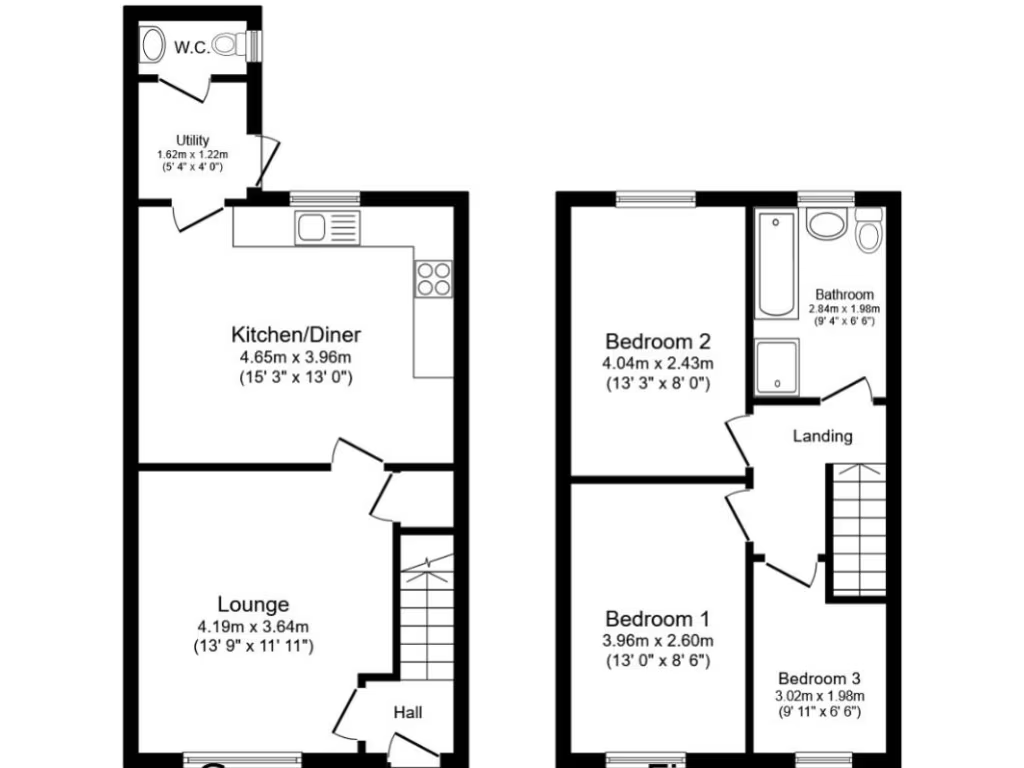

Compact footprint ~725 sq ft; small plot and gardens

EPC rating D; cavity walls assumed uninsulated

High local crime and very deprived area — consider socio-economic risks

Council Tax Band A — low running cost

Double glazing present; install date unknown

A ready-made buy-to-let in Easington Lane offering immediate income and low entry cost. This three-bedroom mid-terrace is newly renovated, double glazed and gas‑central heated, delivering tenant-in-place rental returns from day one. At £80,000 with a reported £475pcm income, it produces a strong gross yield suited to investors building a portfolio.

The layout is practical: a spacious lounge, kitchen/diner, three bedrooms, family bathroom and small enclosed gardens to front and rear. The property is compact (approx. 725 sq ft) and presented turnkey, so there is minimal short-term maintenance expected. Nearby amenities and good local transport links support steady rental demand.

Buyers should note the area context: very deprived locality with high recorded crime and a predominance of hard-pressed rented terraces. The EPC is D and walls are original cavity construction with assumed no insulation, which may affect longer-term energy costs and improvement planning. Double glazing installation date is unknown.

This is a straightforward investment purchase — freehold, tenanted, and council tax band A (low charge). It suits investors seeking an affordable, low-management let, or someone wanting an income-producing property to add to a growing portfolio while budgeting for possible medium-term energy upgrades.