Summary - FLAT B, 21-23 FRIAR GATE, DERBY, DERBY DE1 1BX

1 bed 1 bath Block of Apartments

City-centre mixed-use block with immediate income and short-term re-letting potential.

- Freehold mixed-use block, c.9,029 sq ft, city-centre location

- Producing c.£123,220 pa (c.£100,000 net) with 8.5% net initial yield

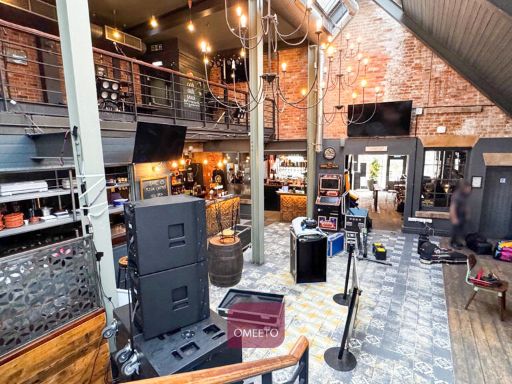

- Pub on long lease with fixed/index-linked uplifts (tenant until 2038/2039)

- Seven residential lets refurbished in 2021; furnished ASTs in place

- Three cluster rooms recently vacated; vendor underwriting three months' rent

- Medium flood risk, very slow broadband and high local crime levels

- VAT-registered commercial element; TOGC may be possible subject to criteria

- Student-focused catchment — demand and lettings seasonal and management-intensive

A prominent freehold mixed-use block in Derby city centre, offered with long-standing pub income and refurbished residential accommodation. The property is producing circa £123,220 pa (approximately £100,000 net after costs) with a quoted net initial yield of 8.5% after estimated purchaser costs of 5.75%. Total area approximately 9,029 sq ft; recently renovated residential units (refurbished 2021) reduce immediate capital expenditure.

Income is underpinned by a popular pub let on a long lease with fixed and index-linked uplifts (documents quote a tenanted pub to 2038 with a fixed increase to £55,000 pa in 2029 and an index-linked review in 2034; other marketing lines reference an effective FRI lease to 2039 at a different rent level). Seven residential lets (2 apartments, 4 studios and a 4-bed HMO) are furnished on ASTs and produced around £75,840 pa gross; three cluster rooms are recently vacated but the vendor will underwrite three months' rent if not re-let.

Key commercial considerations: the pub element is VAT-registered (purchase may be treated TOGC subject to criteria), EPCs range from D to C across units, and the asset sits in a city-centre, student-focused area suitable for investors targeting student lets or short-term stays. Practical drawbacks include a medium flood risk, very slow broadband, high local crime and area deprivation — factors that influence lettings, management and insurance costs.

Overall this is a yield-focused, hands-on investment with immediate income, short-term re-letting potential in student accommodation, and scope to add value through active management. It will suit buyers comfortable operating in a busy city/student neighbourhood and managing mixed-use assets with some location-sensitive risks.

High street retail property for sale in The Friary, Friar Gate, Derby, DE1 1FG, DE1 — £850,000 • 1 bed • 1 bath • 27878 ft²

High street retail property for sale in The Friary, Friar Gate, Derby, DE1 1FG, DE1 — £850,000 • 1 bed • 1 bath • 27878 ft² Commercial property for sale in Babington Lane, Derby, Derbyshire, DE1 — £750,000 • 1 bed • 1 bath • 13961 ft²

Commercial property for sale in Babington Lane, Derby, Derbyshire, DE1 — £750,000 • 1 bed • 1 bath • 13961 ft² Commercial property for sale in The Waterfall, Railway Terrace, Derby, Derbyshire, DE1 2RU, DE1 — £875,000 • 1 bed • 1 bath • 22131 ft²

Commercial property for sale in The Waterfall, Railway Terrace, Derby, Derbyshire, DE1 2RU, DE1 — £875,000 • 1 bed • 1 bath • 22131 ft² 9 bedroom town house for sale in Friar Gate, Derby, DE1 — £360,000 • 9 bed • 9 bath • 477 ft²

9 bedroom town house for sale in Friar Gate, Derby, DE1 — £360,000 • 9 bed • 9 bath • 477 ft² Residential development for sale in 10 Iron Gate, Derby, Derbyshire, DE1 3FJ, DE1 — £450,000 • 1 bed • 1 bath • 3530 ft²

Residential development for sale in 10 Iron Gate, Derby, Derbyshire, DE1 3FJ, DE1 — £450,000 • 1 bed • 1 bath • 3530 ft² Hotel for sale in The Friary, Friar Gate, Derby, DE1 1FG, DE1 — £850,000 • 1 bed • 1 bath • 27878 ft²

Hotel for sale in The Friary, Friar Gate, Derby, DE1 1FG, DE1 — £850,000 • 1 bed • 1 bath • 27878 ft²